Key Outcomes:

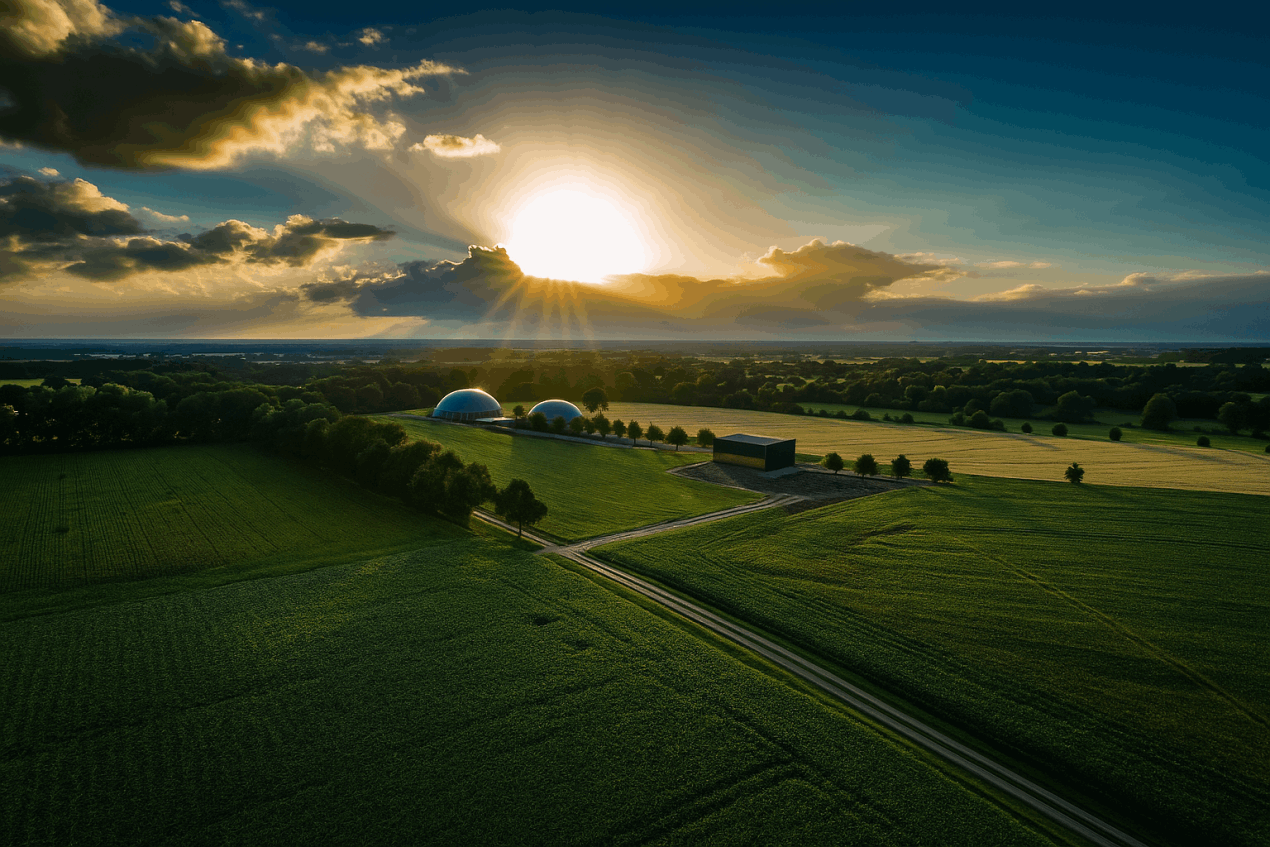

• Emission reduction: The plant has reduced greenhouse gas emissions by over 52,000 tonnes of CO₂ equivalent since operations began in 2020

• Economic Impact: Over 3.3 million kilograms of BioCNG (CBG) have been distributed, generating more than 51.5 million baht in income for local farmers and communities, and creating local employment opportunities25.

• Clean Fuel Alternative: The CBG produced meets the quality standards of natural gas for vehicles (NGV), providing a clean, locally sourced alternative to gasoline and supporting Thailand’s energy diversification goals25.

By capturing methane from cassava wastewater, the plant now provides renewable power to the starch facility and the local grid, replacing fossil fuels and lowering environmental impact, clean BioCNG from biomethane for fleets and factories.